We deliver impact

on a global scale.

Our society and the global economy have reached a decisive moment in time. We face unprecedented challenges—but we also have a huge opportunity to tackle them and build solutions that truly matter.

So far, our 34 portfolio companies are leading the way by addressing 15 UN SDGs and 7 Planetary Boundaries.

And there is so much more work to be done.

What really matters to us

We focus on addressing pressing societal issues in four areas of impact:

Redefining

Healthcare

Improving our exhausted healthcare systems by using novel technologies to advance treatment options and solve structural inefficiencies.

Educational

Empowerment

Providing access to quality education as well as shaping the future of work (e.g. supporting families through affordable child care and lifelong skills).

Sustainability Transformation

Reducing the negative effects of climate change and globalisation. Enabling the broadest possibilities and best quality of life for future generations.

Equitable Humanity

Rethinking every aspect of our daily lives, from fair finance to employment, and promoting a more equal, inclusive and peaceful society.

We are different. Unlike traditional VC funds, our approach is to proactively search for, and select, the most outstanding impact businesses tackling major world issues.

We always measure

We strongly believe that impact investing isn’t worthy of the name unless it is properly measured. As such, we bring more than a decade of impact measurement expertise to the equation, helping companies to set up impact KPIs and targets that are business-driven.

Some impactful highlights:

45

% diverse

founding teams (gender, ethnicity, disability)

130

million

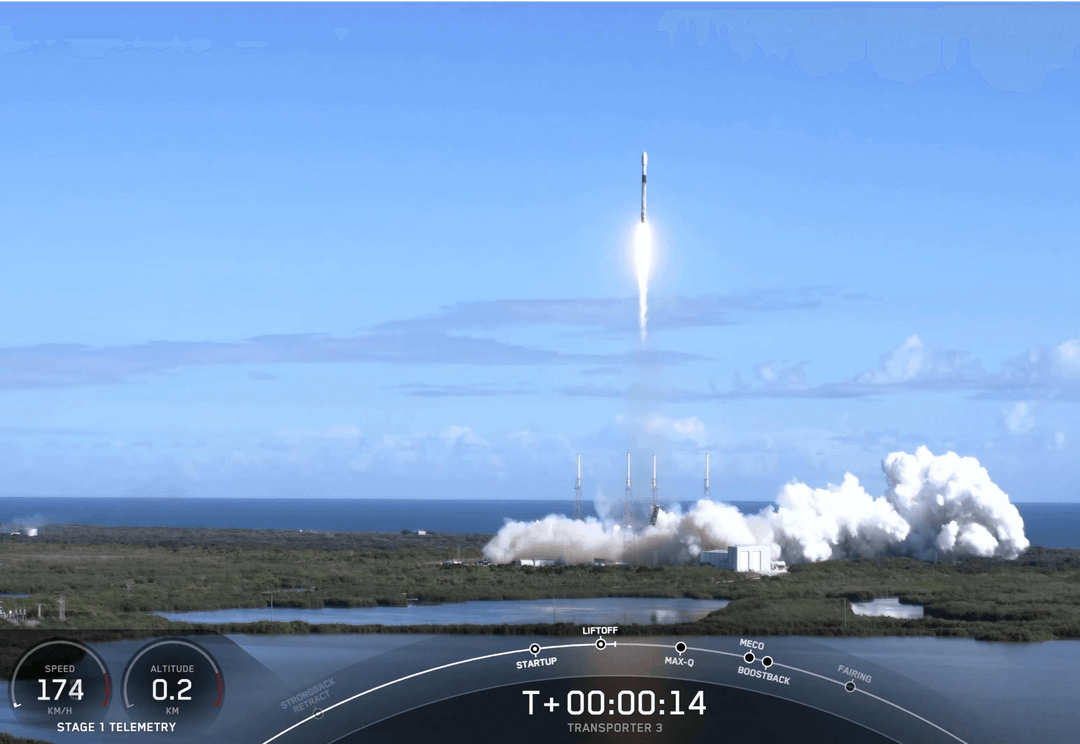

hectares of global forest area covered for improved wildfire detection and monitoring

439

thousand

pupils benefiting from improved learning outcomes

4.5

million

patients receiving better healthcare

10

million

lives touched

400

million

euro unlocked from own source and co-investors

Our ‘Impact Carry’ model

As mission-driven as our founders, their impact targets become our own. We want to invest into impactful companies — with no trade-off between revenue and impact. We take this so seriously that we even link our compensation to achieving this goal.

This guarantees that there is no trade-off between revenue and impact. The formula is simple: more revenue equals more impact. *

0-59

%

impact goals achieved

=

No

carry

independent of financial goals achieved

60

%

impact goals achieved

=

10

% carry

70

%

impact goals achieved

=

15

% carry

80+

%

impact goals achieved

=

20

% carry

* and absolutely no super bonus if we over-deliver on impact and financial goals.

Read our Impact Report

Let’s drive more impact, together.

We are always looking for exceptional founders creating the game-changing impact companies of tomorrow.