Meet the builders rethinking entire systems.

FUND V

We are currently looking to make our first investment from Fund V. Building on more than 15 years of experience, Fund V is designed to support founders obsessed with solving Europe’s most pressing challenges, from biodiversity and ageing to planetary health and biosecurity.

FUND IV

Fund IV reflects our maturity as a leading impact venture capital firm. We backed entrepreneurs who blend cutting-edge tech, scientific insight, and bold missions to solve complex, systemic problems.

Unlocking patient-centric drug discovery with artificial intelligence and population-scale genetics.

FUND III

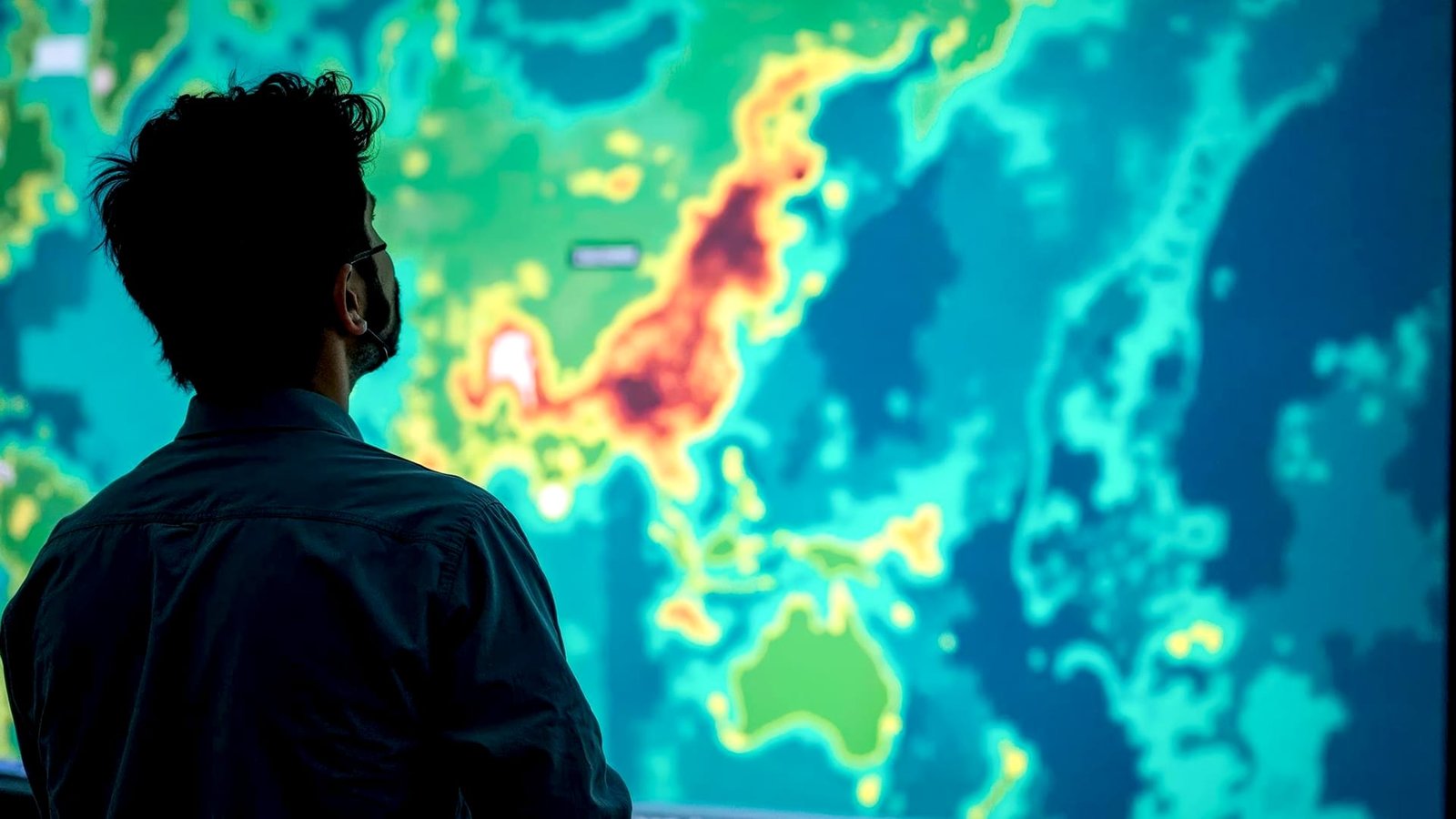

Fund III was our first to back spacetech and next-generation climate ventures. We showed impact investing works at scale, combining measurable outcomes with strong financial returns.

The portfolio includes companies using advanced tech to address regenerative agriculture, climate risk, and healthcare.

FUND II

Fund II, built on the foundations of Fund I, sharpening our focus on scalable social businesses. Still operating in an early market, we continued to prove the viability of impact investing while broadening the spectrum of investments.

Fund I and Fund II demonstrated that impact and returns can go hand in hand, setting the stage for the growth, diversity, and ambition we see in today’s impact ecosystem.

FUND I

Fund I closed with a 2x MOIC in 2022, proving that impact investing works. As the very first Social Venture Fund, we invested in pioneering social businesses at a time when only a handful of such companies existed.

Using a mix of equity and debt instruments, our approach was closer to venture philanthropy than traditional venture capital, but it laid the foundation for everything that followed.